Who are the leading antibody, biochemical and protein suppliers in cancer research?

10

Min Read

In this blog:

- We uncover leading suppliers in the cancer research area

- Which antibody, protein and biochemical suppliers have grown their market share?

- Download data on the top 20 suppliers for each reagent market, taking in data over ten years

With AACR approaching, today we delve into our cancer research data and uncover the leading reagent suppliers supporting this important market with their products.

This analysis provides an update on two blogs from last year which took in citation data for commercially available research reagents and reagent suppliers in the protein cancer research market and antibody cancer research market over the last five years. Today, we analyse market data on the last ten years for a longer view on trends in the market, with a particular focus on supplier share.

We find that there is a dominant leader in the protein, biochemicals and antibody markets. We also see strong growth trajectories for some reagent suppliers in the top ten, showing there may be heightened competition for the top spots in years to come.

Leading reagent suppliers in cancer research

We discover:

- A dominant supplier for protein and biochemical reagents

- An antibody supplier who has maintained the market lead for ten years

For both biochemical and protein cancer research markets, holding their position at the top was MilliporeSigma.

With a 34.7% citation share for their biochemical products, they remain in the lead for this research area, as well as the biochemicals market overall. Similarly, in the protein market MilliporeSigma dominated with a 24.39% market share in 2022, and also in the wider protein market.

If we look at their success in the antibody market, MilliporeSigma came in at 6th position in 2022 by citation share.

Taking the lead in producing antibody reagents that support cancer research are Cell Signaling Technology. Last year, we reported that they led by citation share in this research area; in 2022 they maintain this lead with nearly a third of this important market.

In our blog on leading antibody suppliers and products in cancer research, we took in data over the past five years. Today we examine data extending back ten years, and find that Cell Signaling Technology have led since 2013, showing a strong commitment to producing antibodies that support cancer research.

Abcam came in a strong second position and have increased their share since last year. They now hold 26.13% of the market, growing from 11.51% in 2013. Over the years, they may have taken their share from Santa Cruz Biotechnology, who mirror their growing share trend with a decreasing share in the market. Santa Cruz Biotechnology still rank as the third most cited supplier.

Cancer research market movers and shakers

We discover:

- Growth across all markets for a supplier in the top five

- Considerable growth in individual markets for some challenger companies

Could the cancer research reagent market be seeing some suppliers rising through the ranks in the near future?

In the protein and biochemical market other companies have been increasing their share, which may place pressure on MilliporeSigma’s lead in the future.

For cancer research biochemicals, Thermo Fisher Scientific are close behind the leaders with a 28.62% share. We noticed they’ve been steadily growing over the years. In contrast, MilliporeSigma have been seeing a decreasing share, although they have confidently maintained their lead in the market.

Similarly in the protein market, we saw that Thermo Fisher Scientific have been growing their share and hold 13.07% of the market by citations. Although this is not enough to threaten the leader, the reagent supplier has recently acquired Peprotech (we took a look at this acquisition in a recent blog on life science acquisitions). Peprotech hold a share of 14.59% in the protein cancer research market. Combining both suppliers’ shares make them a strong contender in the protein reagent space. Both companies have grown their protein citation share since 2013, although the pace of this growth slowed slightly in recent years.

In the antibody market, we also see success for Thermo Fisher, with their Invitrogen Antibodies brand. Invitrogen Antibodies have been increasing their share consistently and rank as the fifth most cited supplier.

Another important player in the biochemicals market, MedChemExpress, has been gaining impressive momentum since 2016. Their share has rocketed from 0.12% to 7.9% in 2022, positioning them as the fourth largest biochemical supplier in the cancer research field. They may be a supplier to watch in the coming years, threatening larger companies if their growth continues in this way.

In the protein market, companies such as New England BioLabs have been growing their citation share consistently over the past five years. New England Biolabs also rank as the third most cited supplier overall in the protein market. It is therefore perhaps not surprising we see their success in this important area within the overall protein market.

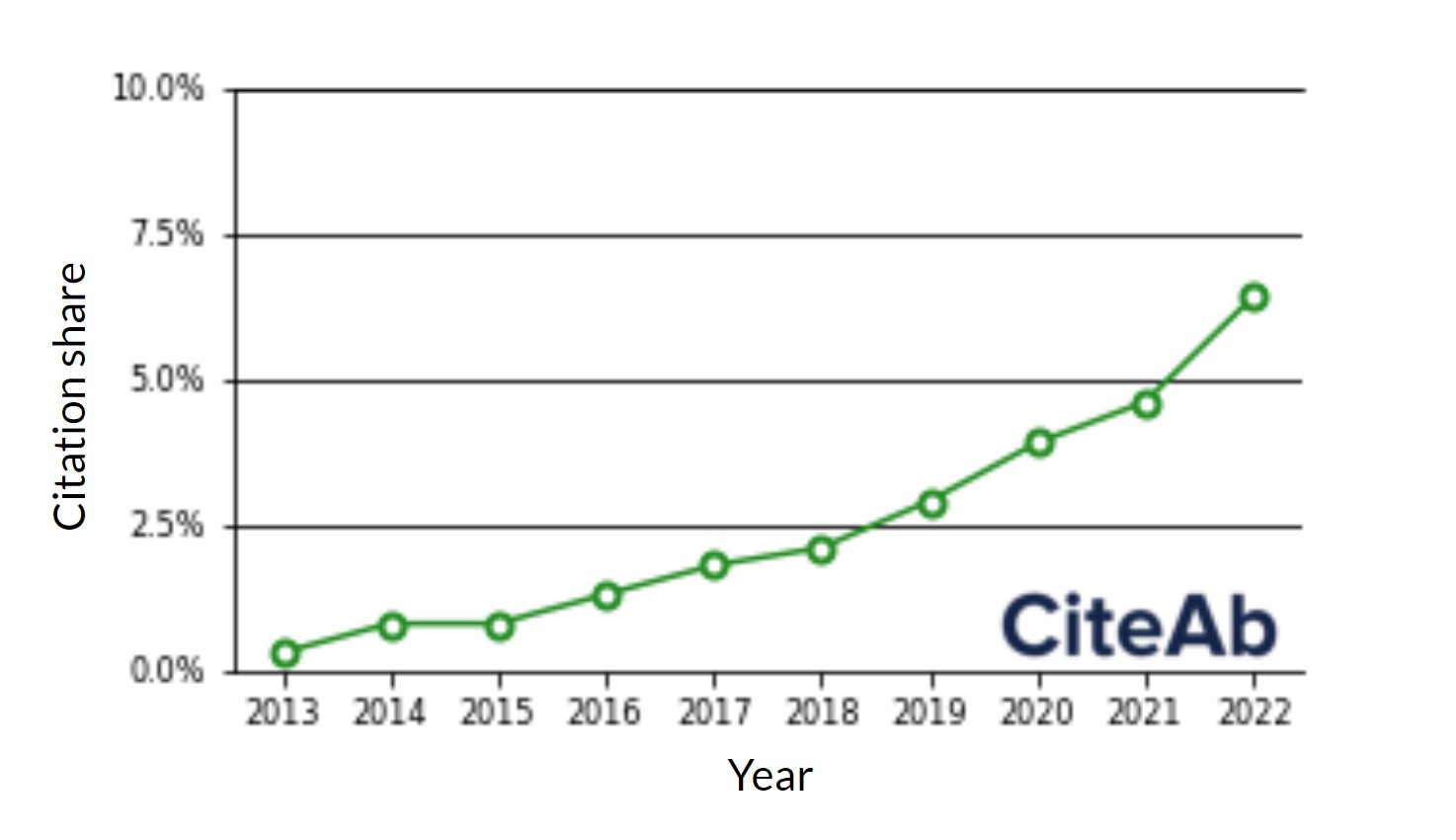

In the cancer research antibody space, one supplier in particular has seen an impressive growth in citations since 2013, showing significant support for cancer research with their products.

Proteintech have grown their share from 0.38% to 6.49% in 2022. As of last year, they overtook MilliporeSigma and Invitrogen Antibodies to come in as the 4th most cited supplier in 2022 within cancer research antibodies. Their increasing growth rate between suggests they could take a place in the top three cancer research antibody suppliers in coming years if this trend continues.

Well cited suppliers for cancer research antibodies, biochemicals and proteins

We discover:

- Significant players in the biochemicals space maintaining share

- Leaders across all markets seeing slight decline in citation share

Important players to also pay attention to in the biochemicals space include SelleckChem and Tocris, in the protein market R&D Systems and Santa Cruz Biotechnology in cancer research antibodies.

SelleckChem have maintained their considerable share in biochemicals over the years – not seeing significant growth but also not seeing decline. They hold a steady share of around 10%, and have done so for seven years, showing they perform well in this market and have consistently supported cancer research with their products.

Taking the fifth most cited supplier spot in the biochemicals market is Tocris, part of Bio-Techne. Although they have maintained their spot in the top five, they have seen a gradual decrease in share since 2012, and hold 1.2% of the market.

Similarly in the proteins market, R&D Systems have seen a negative trajectory over the past ten years. In spite of this, they still claim an impressive 11.3% citation share and are the fourth most cited supplier in 2022.

For the cancer research antibodies market, Santa Cruz Biotechnology claimed 3rd position both in 2022, with a 8.13% share, and with their overall citation share between 2013-2022. MilliporeSigma are also a supplier to watch in this area, claiming the 6th largest number of citations in 2022. Both Santa Cruz Biotechnology and MilliporeSigma have seen their share decrease since 2013, but remain strong leaders in this space.

What data was used in this analysis?

To put together this analysis, we drew on our comprehensive citation database. We mine the scientific literature (both open access and subscription only journals) using AI and human reviewing to understand product usage for antibodies, biochemicals, proteins, experimental models and kits & assays.

To specifically drill down into data within cancer research, we assign publications with a research area. Citations we find in unstructured free text and tables from these publications are assigned to this research area.

To date, we have mined over 6 million citations, covering 12 million products.

Want to discover more about the antibody, protein or biochemicals market?

We offer a variety of data products, including full dataset subscriptions, custom datasets and more, giving insights such as those discussed in this blog.

You can also freely download data to perform some of your own analysis below! We are giving away data on the top 20 antibody, biochemical and protein suppliers between 2013-2022.

Finally, we hope to see you at AACR soon! Get in touch with the team to set up a meeting.

- Rebecca and the CiteAb team

Sign up for data

Something seems to have gone wrong while loading the form.

Drop us a message and we can send you the data directly.