Leading antibody suppliers and products in cancer research

5

Min Read

In this blog:

- Who are the leading and challenging antibody suppliers within cancer research?

- What are the top cited products?

- Sign up to download data on the top 50 cited cancer research suppliers and top 50 antibodies

Having recently returned from AACR, we thought it an opportune time to look further into the cancer research field. For our blog today, we analysed our data which contains hundreds of thousands of citations from cancer research publications.

We were fascinated to find a few leading companies with significant upward growth trajectories over the past five years, alongside a clear leader with consistent citation share. Is this set to change? And what products are these suppliers providing?

Who is leading this market?

Cell Signaling Technology have dominated this market for many years, holding a 33% market share. In fact, they were recently recognised for their success in this area with a win in the 2022 CiteAb Awards in the ‘Supplier Succeeding in Cancer Research’ category, which is awarded based on our citation-based market data.

Impressively, Cell Signaling Technology have led the field over the last 5 years by maintaining their high market share. Currently, they supply 7 of the top 10 cited products in cancer research. Cell Signaling Technology have supported more cancer research and cancer researchers than any other supplier – no small feat.

Movement in supplier share

We have noticed a number of other top 10 companies making gains in the cancer research market (share value is determined by % of citations from CiteAb market data).

Abcam now claims a strong 25% market share, up from 16.7% in 2016. This is impressive growth, and perhaps not surprising given that we recently noted Abcam were the top research antibody supplier in 2020 and have grown the number of their products in the top 100 antibodies in 2020. Their success expands beyond antibodies, with an increasing share in the cancer research protein market also.

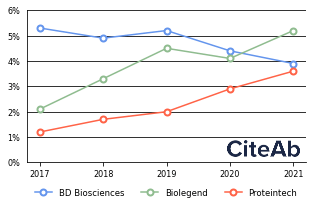

Another company showing a strong upward trajectory is BioLegend. They have significantly increased their citation share from 2% to 6% over the last five years, and are now the fourth most cited supplier. Santa Cruz Biotechnology claim a strong third place for citation share, although they have not followed the same trend as Abcam and BioLegend, instead dropping an 8% market share value.

Another supplier increasing in citation share is Proteintech, illustrated in the graph to be following a similar trajectory to BioLegend. BD Biosciences, in contrast, have been reducing in share, although they still hold a strong position in the market.

–

Top cited products and targets

But what are these suppliers selling? We found the top cited product to be Phospho-Akt (Ser473) (D9E) XP ® Rabbit mAb (4060 Cell Signalling), with over 7000 citations in the CiteAb search. Akt is a kinase, commonly found to be altered in human cancer cells.

Immunohistochemistry image using the Phospho-Akt (Ser473) (D9E) XP ® Rabbit mAb antibody (top cited product). Image collected and cropped by CiteAb under a CC-BY license from: G. Prodromidis et al. Int J Dent. (2013) https://pubmed.ncbi.nlm.nih.gov/24228033/

CST supplies the majority of products in the top 50, consistent with their very high share of the market. It was interesting that no BioLegend products feature in the top 50, despite their strong growth trajectory – could this be something set to change in the near future?

The top 50 products broken down by supplier.

It was also illuminating to look further into the popular targets for these top cited antibodies, giving us insight into current avenues of research. Alongside Akt, other top cited protein targets included Glyceraldehyde-3-phosphate dehydrogenase, Actin, Caspase-3 and Mitogen-activated protein kinase 3.

Found this data interesting?

By signing up below you can download sample data on the top 50 products and top 50 suppliers in cancer research for your own further analysis.

Cancer research is just one of 13 individual research areas we analyse. We now provide a market insights package for antibodies, proteins and biochemicals which comes as quarterly themed data deliveries – this month’s being those 13 ‘ research areas’. Within each research area the top cited products, suppliers and institutions are included, covering data over the past two years.

If this sounds of interest please get in touch with us for further information.

- Rhys and the CiteAb team

Sign up for data

Something seems to have gone wrong while loading the form.

Drop us a message and we can send you the data directly.