Two years on – how are ‘growing’ antibody suppliers faring?

It has been a few years since we last checked in on our data for antibody supplier growth, so today we’re catching up with product manager Rhys Williams to see whether predictions we made in 2016 and 2017 have panned out.

Rhys, can you remind us which the growth companies were back when we last looked at this data?

Yes – in 2016 we did an analysis of the companies we thought it was worth keeping a close eye on, those with interesting growth trajectories that looked set to continue. We also highlighted the companies that were best set to challenge the biggest players in the global antibody market. Today we’re going to take a fresh look at a few of these – focusing on BioLegend, Proteintech and Bioss.

What data has been analysed to produce today’s update?

Today’s update is as a result of analysis of nearly one million specific antibody citations from the last nine years for over 150 suppliers. This is our recently updated annual dataset looking at supplier shares of the global research antibody market.

In 2016 BioLegend was a growth company. How does it fare today?

BioLegend was highlighted in our 2016 report for having a notable positive trajectory with impressive growth. At the time, BioLegend was the tenth largest company in the global research antibody market. When we revisit the data for this company, it’s clear that our expectations of seeing further growth were correct – BioLegend is now the seventh largest supplier of research antibodies and as per our 2016 analysis, it seems even more likely that it will go on to challenge the biggest players in the near future.

Have any other companies gained positions in the global market?

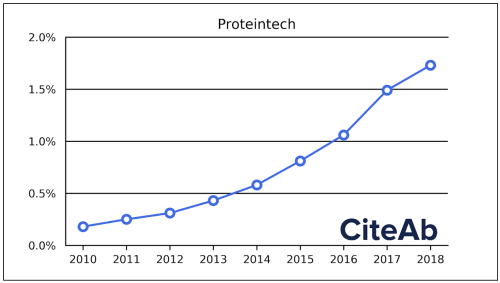

Yes – one worth a mention is Proteintech. Back in our 2016 report we highlighted the company as it had captured over one per cent of the global market in a short period of time and was demonstrating impressive growth. At the time we discussed the future for Proteintech, stating that if the company could maintain its growth rate then we’d be seeing it break into the top ten suppliers within a few years. Well, that has now happened with Proteintech sitting in ninth position and well on its way to capture two percent of the market.

Has growth slowed for any of the suppliers we’ve been watching?

Well Bioss is an interesting company – back in 2016 it caught our attention because although it was a really tiny supplier it was seeing spectacularly fast growth, gaining market share rapidly between 2014 and 2016. When we look at our latest data for this company we can see it has maintained this positive trajectory, but not with quite the ferocity that we saw back then. Still, impressive progress means Bioss has climbed the supplier share ladder and now sits at 19th position, up from 21st in 2016. It will be interesting to see what the future holds and whether Bioss can continue to maintain steady growth in coming years.

How can companies learn more about their global market position?

Here today we have taken an updated look at just three antibody suppliers, however there are many more suppliers with interesting trends in this fast-changing market. Our supplier share market dataset and report covers over 150 of these suppliers, so anyone wishing to learn more about the position of their company or that of their closest competitors can contact me to discuss the full dataset. You can also sign up below for alerts about new and updated datasets and to receive free data from time to time.

– Alicia and the CiteAb team